In this age of technology, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. Whether it's for educational purposes in creative or artistic projects, or simply to add an element of personalization to your home, printables for free have become a valuable resource. Here, we'll dive to the depths of "How To Write A Form 990 Late Filing Penalty Abatement Letter," exploring the different types of printables, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest How To Write A Form 990 Late Filing Penalty Abatement Letter Below

How To Write A Form 990 Late Filing Penalty Abatement Letter

How To Write A Form 990 Late Filing Penalty Abatement Letter -

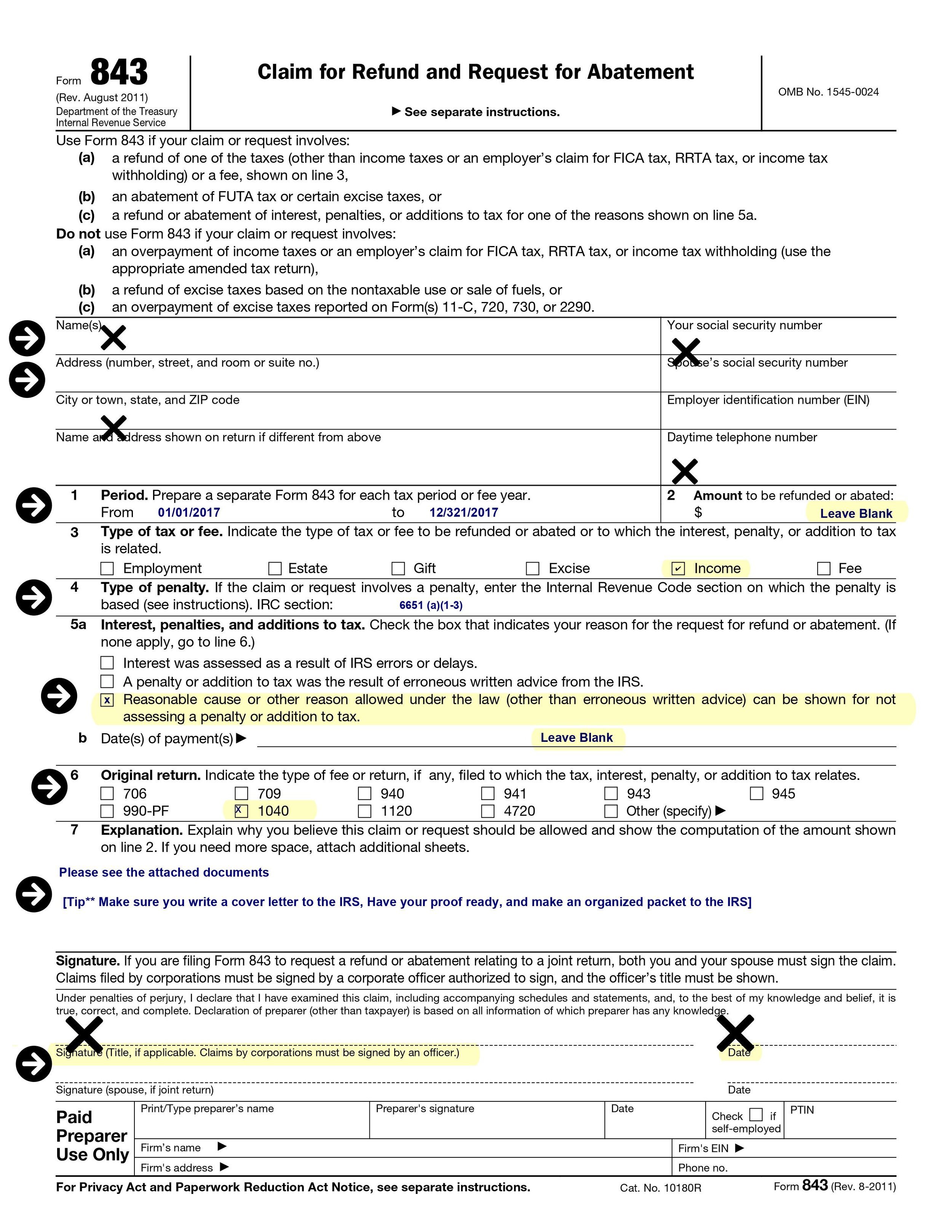

Learn about the opportunity for penalty abatement for late filing of Form 990 and get an overview of the elements contained in a successful reasonable cause

A filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances You may make the request in response to a

How To Write A Form 990 Late Filing Penalty Abatement Letter cover a large assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in various designs, including worksheets templates, coloring pages and much more. The value of How To Write A Form 990 Late Filing Penalty Abatement Letter is their versatility and accessibility.

More of How To Write A Form 990 Late Filing Penalty Abatement Letter

How To Remove An IRS Form 990 Late Filing Penalty Write An Effective

How To Remove An IRS Form 990 Late Filing Penalty Write An Effective

You can write a letter to the IRS to request relief from late filing late payment late deposit and late information return penalties Make sure you meet the payment and compliance requirements before sending your letter

How to remove Form 990 late filing penalties Learn how to write a letter that will get your penalties removed Example letters and penalty manual written by a CPA who specializes in nonprofits and IRS compliance issues

How To Write A Form 990 Late Filing Penalty Abatement Letter have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: You can tailor the design to meet your needs when it comes to designing invitations to organize your schedule or decorating your home.

-

Educational value: These How To Write A Form 990 Late Filing Penalty Abatement Letter provide for students from all ages, making these printables a powerful source for educators and parents.

-

Simple: instant access the vast array of design and templates, which saves time as well as effort.

Where to Find more How To Write A Form 990 Late Filing Penalty Abatement Letter

Letter For Abatement Of Penalty word docx

Letter For Abatement Of Penalty word docx

Once the organization has been assessed a penalty it is then time to write a proper and thorough request for abatement of late filing penalties under the reasonable cause

Expect to get a letter assessing penalties for all of the years for which Form 990 was late Write a separate abatement request letter for each penalty notice even if each letter

In the event that we've stirred your interest in How To Write A Form 990 Late Filing Penalty Abatement Letter we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of needs.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing How To Write A Form 990 Late Filing Penalty Abatement Letter

Here are some inventive ways that you can make use use of How To Write A Form 990 Late Filing Penalty Abatement Letter:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home or in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

How To Write A Form 990 Late Filing Penalty Abatement Letter are a treasure trove filled with creative and practical information for a variety of needs and preferences. Their availability and versatility make they a beneficial addition to the professional and personal lives of both. Explore the plethora that is How To Write A Form 990 Late Filing Penalty Abatement Letter today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printables for commercial purposes?

- It depends on the specific terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions regarding their use. Always read the terms and regulations provided by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit the local print shops for higher quality prints.

-

What software do I need to run printables at no cost?

- The majority of printed documents are as PDF files, which can be opened with free software like Adobe Reader.

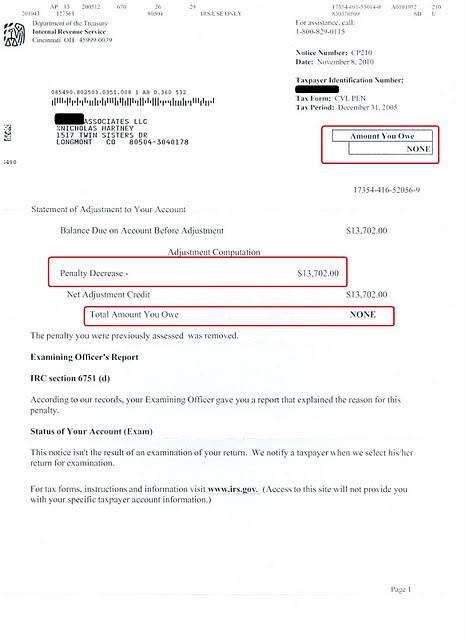

How To Remove IRS Tax Penalties In 3 Easy Steps Get Rid Of Tax

Sample Letters To Irs For Abatement Of Penalties Onvacationswall

Check more sample of How To Write A Form 990 Late Filing Penalty Abatement Letter below

Irs Penalty Abatement Letter Address Letter Resume Examples AlOdMjVXk1

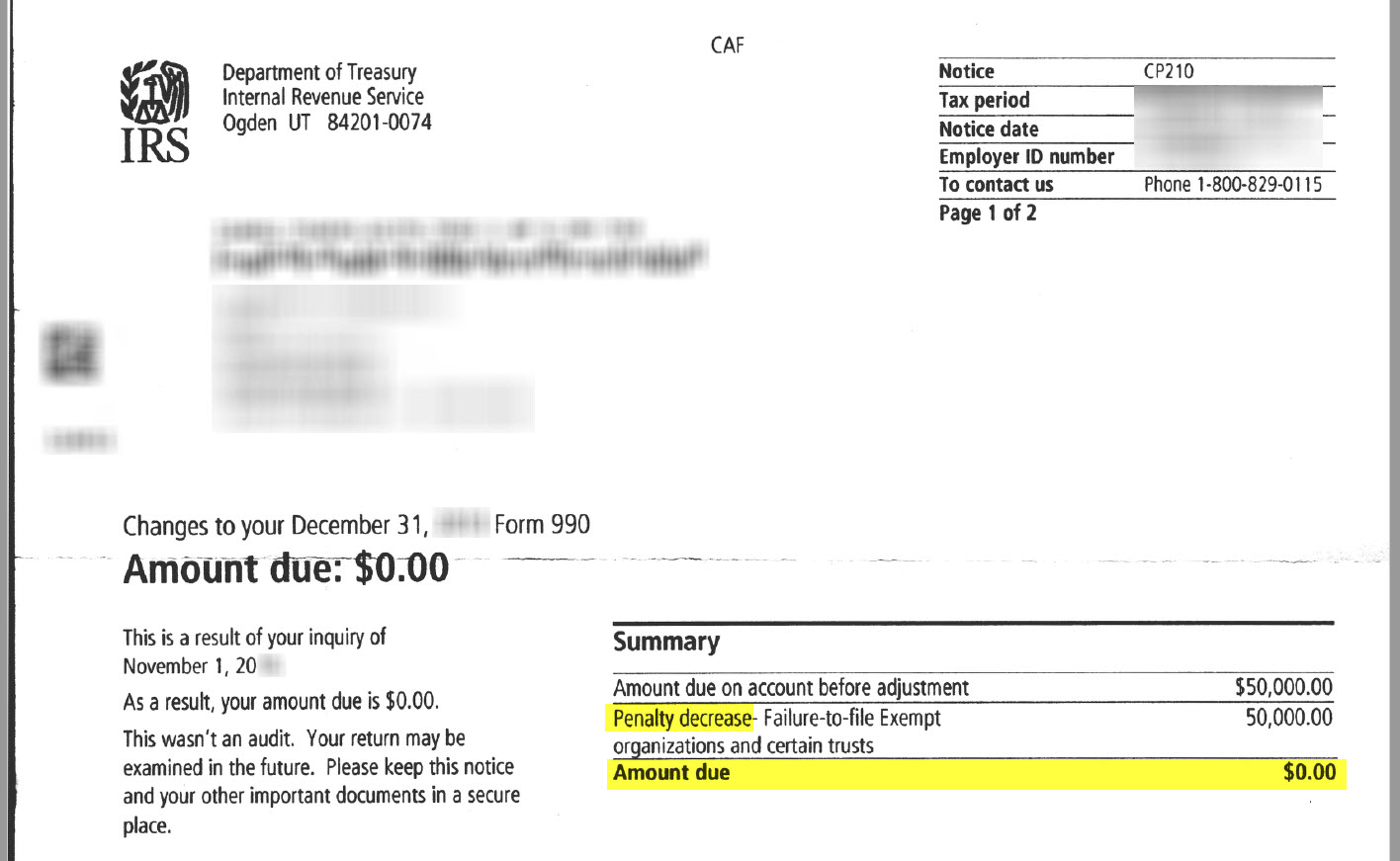

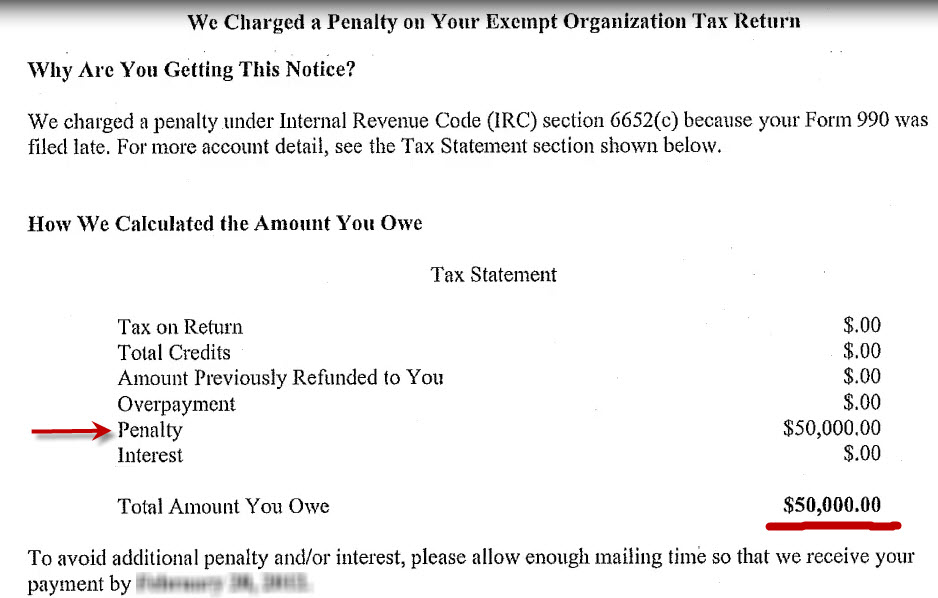

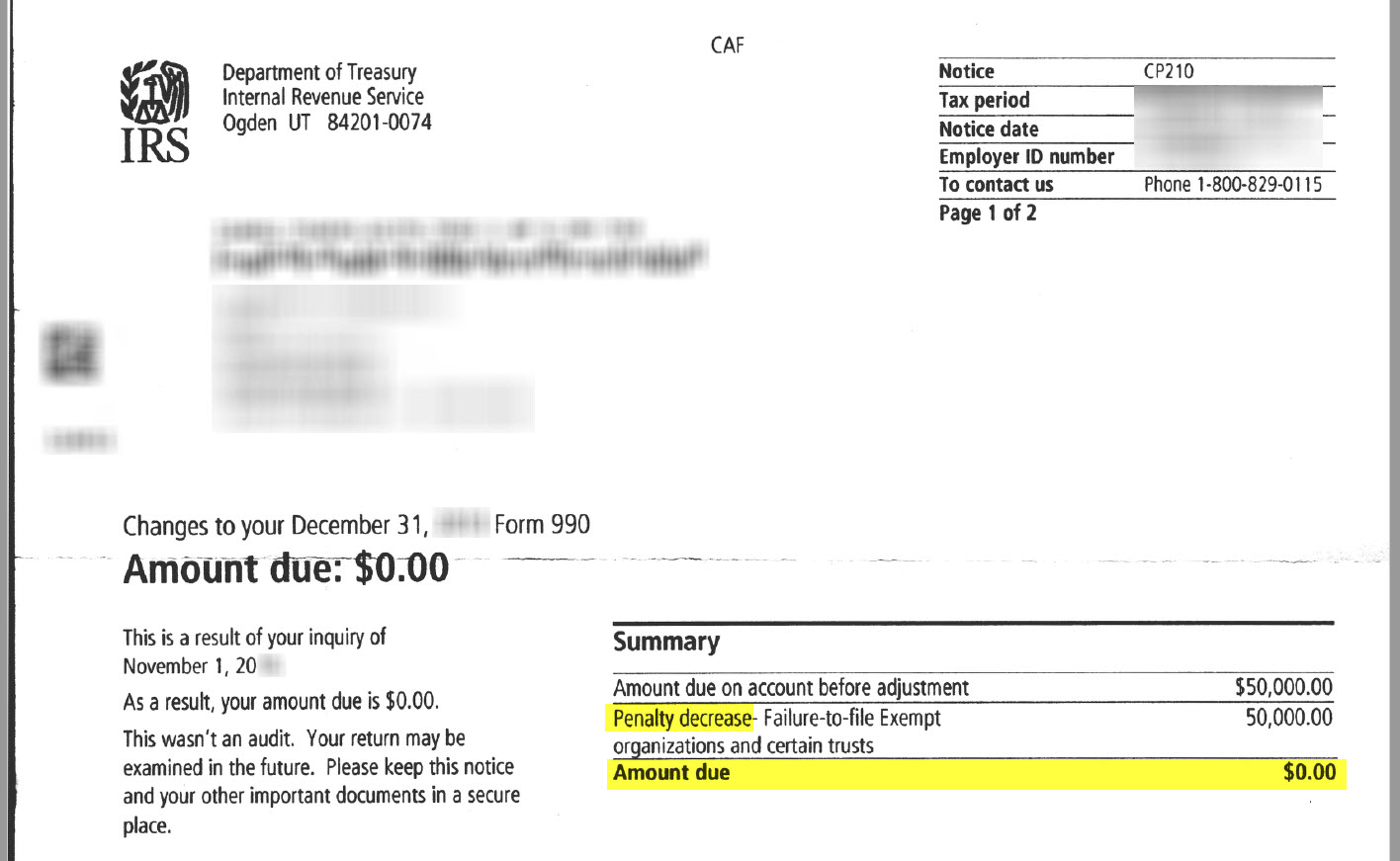

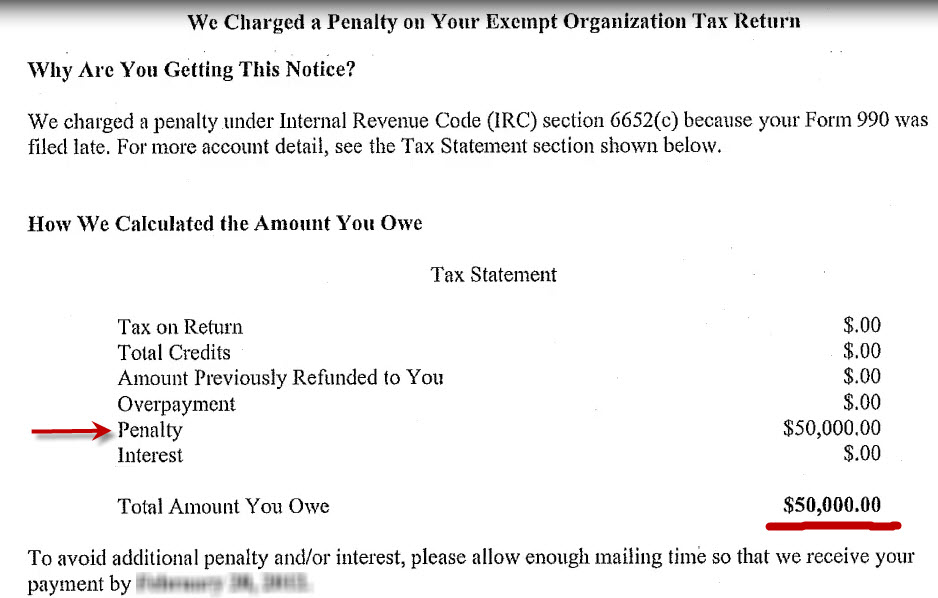

How To Write A Form 990 Late Filing Penalty Abatement Letter 50 000

How To Write A Form 990 Late Filing Penalty Abatement Letter

IRS Form 990 Penalty Abatement Manual For Nonprofits Published By CPA

Sample Letter To Irs To Waive Rmd Penalty Letter Resume Template Vrogue

How To Remove An IRS Form 990 Late Filing Penalty Write An Effective

https://www.irs.gov/charities-non-profits/annual...

A filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances You may make the request in response to a

https://www.advicefortaxpreparers.com/l…

Step 1 Tell your client to relax Let them know that the IRS is not going to show up like the Men in Black to take the charity s assets As long as the client responds to each letter it is a slow road through the IRS

A filer may request abatement of a penalty in a written statement setting forth all the extenuating circumstances You may make the request in response to a

Step 1 Tell your client to relax Let them know that the IRS is not going to show up like the Men in Black to take the charity s assets As long as the client responds to each letter it is a slow road through the IRS

IRS Form 990 Penalty Abatement Manual For Nonprofits Published By CPA

How To Write A Form 990 Late Filing Penalty Abatement Letter 50 000

Sample Letter To Irs To Waive Rmd Penalty Letter Resume Template Vrogue

How To Remove An IRS Form 990 Late Filing Penalty Write An Effective

Sales Tax Penalty Waiver Sample Letter Form 990 Late Filing Penalty

Penalty Abatement Sample Letter To Irs To Waive Penalty Cover Letters

Penalty Abatement Sample Letter To Irs To Waive Penalty Cover Letters

Sample Irs Letter To Request First Time Penalty Abatement